The smart Trick of Medicare Advantage Plans That Nobody is Discussing

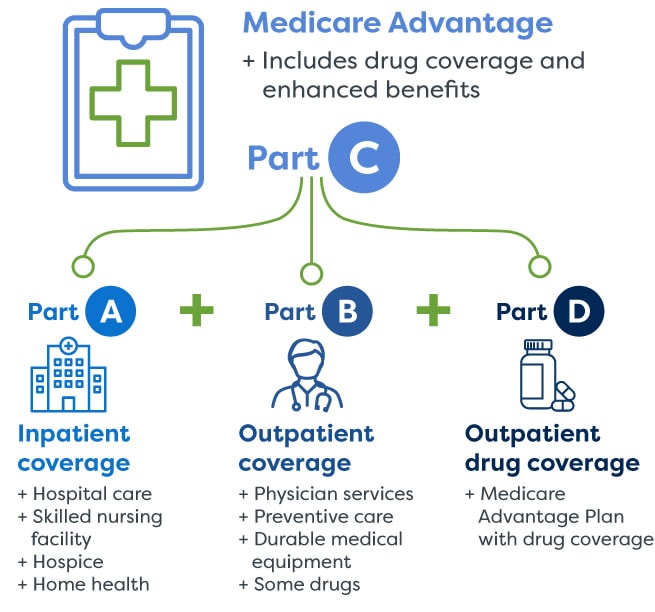

Medicare Benefit intends, additionally called Medicare Part C strategies, run as personal health insurance plan within the Medicare program, offering as insurance coverage choices to Initial Medicare. In most cases, Medicare Benefit intends give even more services at an expense that coincides or more affordable than the Original Medicare program (Medicare Agent Near me). What makes Medicare Advantage prepares negative is they have extra restrictions than Initial Medicare on which physicians and also clinical facilities you can use.

Most of the costs with Medicare Benefit intends come from copays, coinsurance, deductibles as well as other out-of-pocket costs that emerge as part of the total treatment procedure. As well as these prices can promptly escalate. If you need expensive treatment, you could wind up paying more expense than you would with Original Medicare.

The majority of Medicare Benefit plans have their own plan deductible. This suggests a recipient could spend extra for a five-day medical facility keep under Medicare Benefit than Original Medicare.

A Biased View of Medicare Advantage Plans

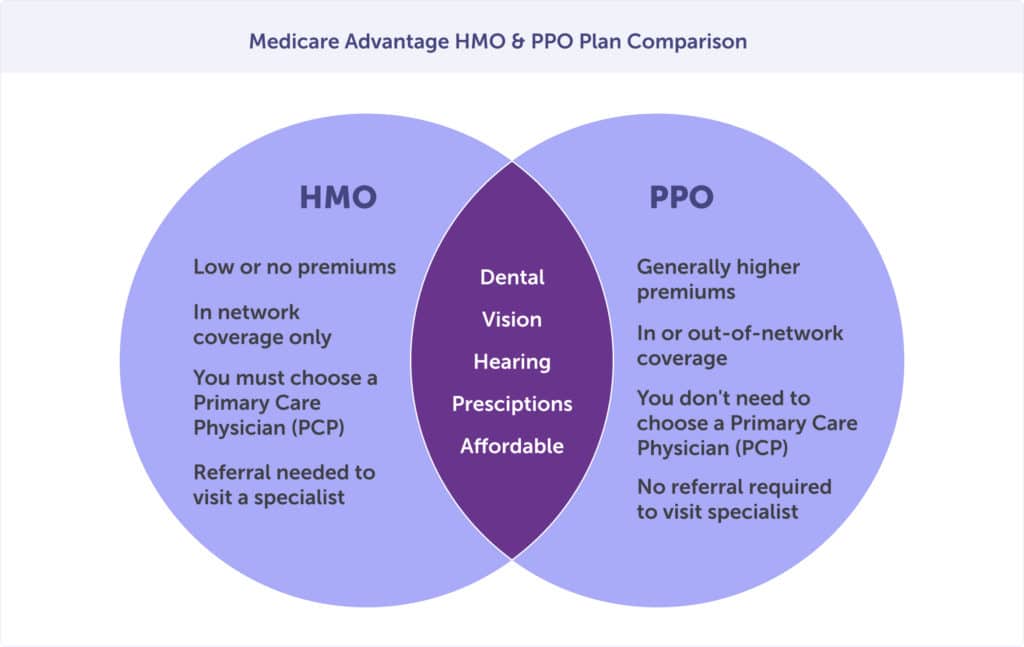

This is particularly great for those who have ongoing medical problems due to the fact that if you have Components An and B alone, you will not have a cap on your clinical costs. Going outside of the network is allowed under numerous Medicare Advantage chose provider strategies, though clinical expenses are more than they are when staying within the plan network - Medicare Advantage Plans.

Suppliers must approve the terms and also conditions of the strategy. Carriers have the option of accepting or denying care with every check out, developing feasible disturbances in treatment. Emergency situation treatment is constantly covered.: These strategies give benefits and services to beneficiaries with particular requirements or restricted earnings, customizing their advantages to satisfy the requirements of certain populaces.

plans: These strategies employ high-deductible insurance coverage with clinical interest-bearing account to help you pay health care costs. These strategies are possibly not ideal for someone with chronic problems due to the fact that of the high deductibles. It is very important to bear in mind that all, some or none of these strategy kinds may be available, depending upon what part of the nation you stay in.

More About Medicare Agent Near Me

Medicare Benefit is a stand-alone plan that packages your protection - Medicare Advantage Plans. On the various other hand, Medicare supplementary plans are add-on strategies that are just available to beneficiaries in the Original Medicare program. Medicare Components An and B pay for regarding 80% of Medicare prices under Original Medicare, developing voids in insurance coverage loaded by supplementary policies.

Beneficiaries can see any kind of provider in the nation that approves Medicare. International travel, Strategies do not cover international travel wellness expenditures. Beneficiaries can have both Medicare and employer-sponsored health and wellness insurance policy at the very same time.

In other words, a chronically sick beneficiary would possibly profit more by having the more comprehensive variety of suppliers offered through Original Medicare and also Medigap. Medicare Advantage strategies are best fit for healthy beneficiaries that do not use many health treatment services. With a Medicare Benefit strategy, this kind of insurance policy holder can come out ahead, paying little in the way of premiums and also copays while making use of benefits to stay their website healthy such as gym subscriptions, which are offered as part of some strategies. Medicare Agent Near me.

An Unbiased View of Medicare Advantage Plans

Medicare Benefit plans are a popular private insurance alternative to Medicare. However, there are some pros and cons to Medicare Advantage. While some Medicare Advantage prepares offer lasting financial savings, strategy adaptability, as well as better treatment, others can lead to fewer carrier alternatives, added prices, as well as way of life obstacles. In this article, we'll explore some advantages and downsides of Medicare Advantage prepares, as well as just how to enroll on your own or a loved one in Medicare.

This suggests that your doctor proactively interact to coordinate your care in between various kinds of medical care services and medical specializeds. This guarantees you have a medical care group as well as aids prevent unnecessary expense and also issues like drug communications. In one, scientists found that worked with care was related to higher person scores and even more favorable clinical personnel experiences.

The Buzz on Medicare Supplement Agent

Original Medicare offers the same coverage throughout the United States. Picking the ideal Medicare Benefit strategy for your requirements can be complicated.

The info on this site may aid you in making personal decisions about insurance coverage, but it is not intended to provide advice concerning the acquisition or usage of any type of insurance coverage or insurance coverage items. Healthline Media does not transact the company of insurance in any fashion as well as is not certified as an insurer or producer in any kind of united state

Healthline Media does not recommend or support any kind of 3rd parties that may transact business of insurance policy.

The Main Principles Of Medicare Part D

Medicare Advantage strategies can offer even more worth than Initial Medicare alone. With the best strategy, you can minimize prices for oral, vision, prescription medication coverage, and extra. Because personal insurance providers like Anthem supply Medicare Benefit plans, you likewise have extra flexibility with your plan choice. The majority of Medicare Benefit plans include benefits you may require that are not covered by Original Medicare, including: Routine dental care, including X-rays, examinations, and also dentures.